Payroll Release Update on the 2025 Nigerian Tax Reform (NITA) – November 2025

On June 26, 2025, Nigeria signed the Nigeria Tax Act (NITA) into law, with an effective date of January 1, 2026. This legislation introduces significant changes to PAYE (Pay-As-You-Earn) tax calculations for Nigerian employees. Our current payroll system is based on the Finance Act 2020 and will require updates to comply with the new structure.

What’s New

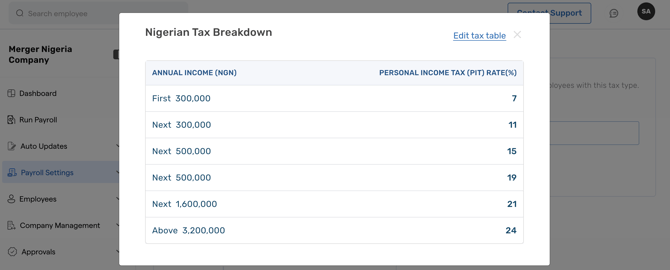

- Progressive Tax Bands: Six new tax rates replace the existing structure.

- Higher Exemption Threshold: Employees earning less than ₦800,000 annually will pay zero tax.

- Rent Relief Allowance: Replaces the Consolidated Relief Allowance with new calculation rules.

- Effective Date: All payroll systems must switch to the new structure by January 1, 2026.

This update ensures compliance with NITA and accurate tax processing for Nigerian employee.

Old Tax Table (FINACT 2020)

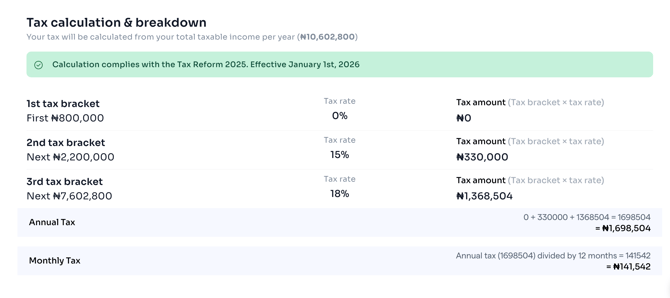

New Tax Table (Tax Reform 2025)

Nigeria Tax Reform 2025: Key Changes and Implementation

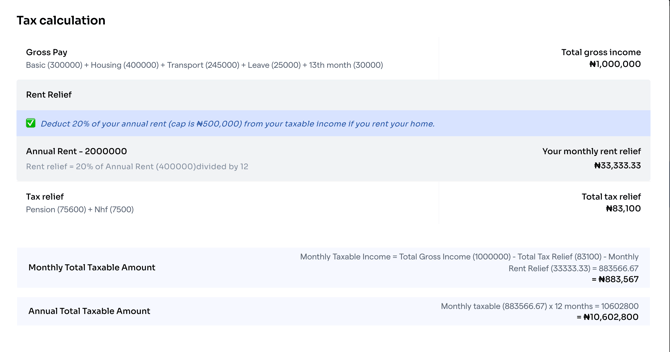

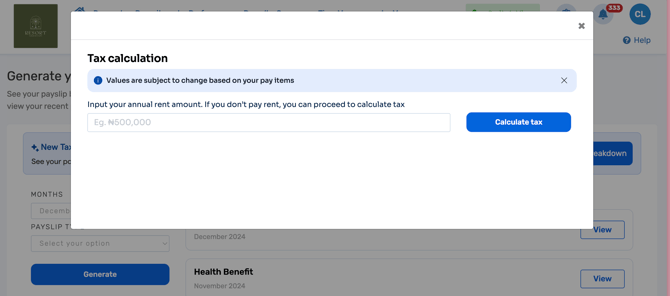

1. Rent Relief Allowance (RRA)

Rent Relief Allowance (RRA) now replaces the Consolidated Relief Allowance under NITA. We’ve introduced RRA in both Payroll and HRIS, enabling admins and employees to record annual rent in the employee profile. This value is used to calculate tax relief during payroll runs.

RRA Calculation:

20% of annual gross income or ₦500,000, whichever is lower. Other reliefs, such as pensions, remain unchanged.

Recommendation:

To enable proper monitoring of changes in rent amount on the employee profile, we recommend the following:

- Admins can enable profile update approval for rent field updates to monitor changes.

- Option to require employees to upload rent certificates for clients that need supporting documentation.

2. Steps to Apply the 2025 Tax Reform

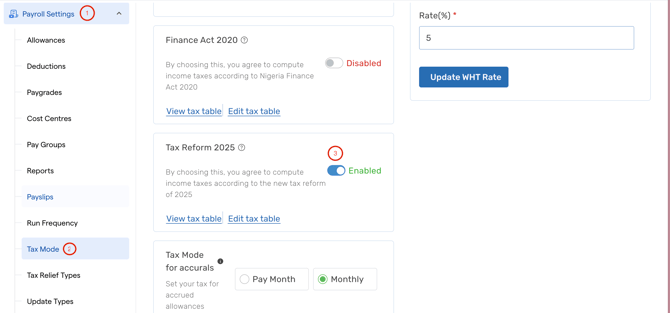

- Enable Tax Reform 2025 Mode under Tax Mode in Payroll Settings.

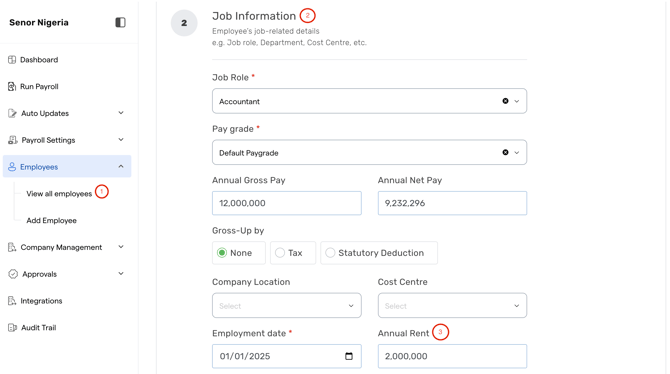

2. Ensure annual rent is included in the employee’s contract for accurate RRA computation. This can be done in both HRIS and Payroll (Standalone clients).

Rent field (Payroll)

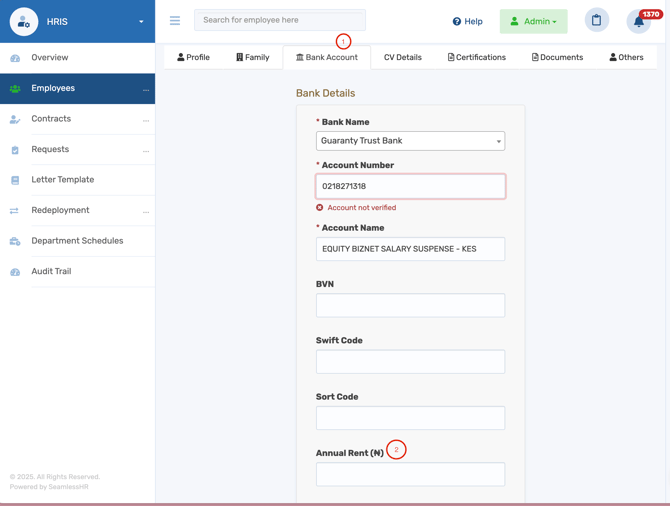

Rent field (HRIS)

3. Once steps 1 and 2 are completed, employees’ taxes will be computed according to the new tax law.

N.B. Here is a NITA Tax Breakdown Computation template to confirm the computations.

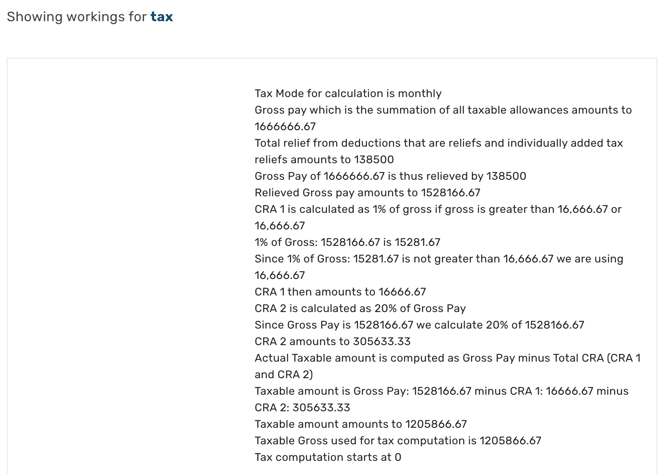

2. Improved Tax Breakdown Page

The tax breakdown page has been enhanced to deliver a clearer and more intuitive view of tax computations, making it easier for admins to understand how employees' taxes are computed.

Old Tax breakdown page

New Tax Breakdown page