How to Add a Proratable Deduction for Suspension and Absenteeism as a Payroll Update.

Follow the steps below to add a proratable deduction on payroll.

- Click on the run payroll by the left pane.

- Click on the view updates if you have an open payroll run or click on run payroll at the top to run a new payroll.

- Click on the updates button in the payroll updates section.

- Fill in the employee's name.

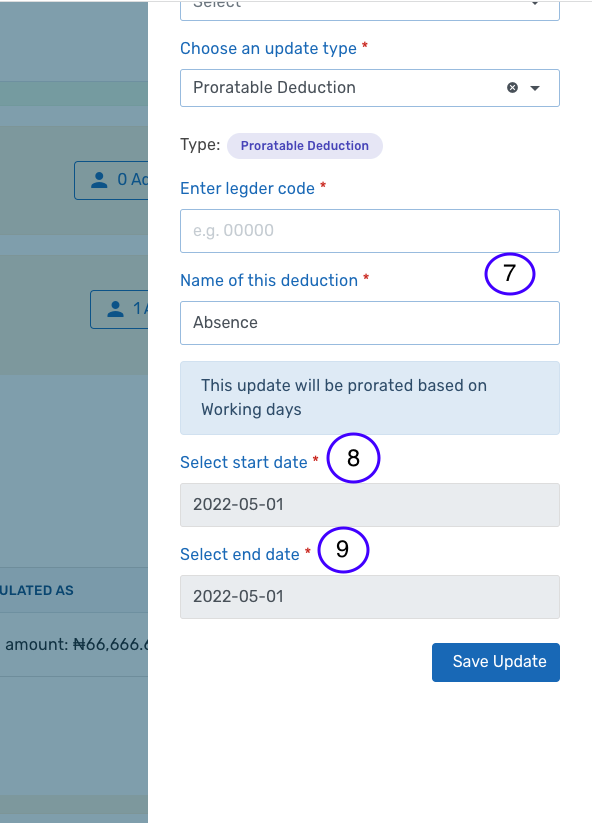

- Choose the update type "Proratable Deduction"

- Input the ledger code.

- Input the name of the deduction.

- Choose the start date.

- Choose the end date.

The start and end dates are the dates the employee is absent or suspended.

10. Click on the save updates button to complete the process.